You don’t raise from a spreadsheet. You raise from people—who, in turn, listen to people they already trust. That’s the core of relationship-led fundraising: use your network (and your team’s) to find the right path to the right investor at the right moment, make a clean ask, and keep context tight so momentum never dies between emails.

This is your playbook—practical, founder-tested steps that pair modern best practices with a calm workflow in Rolodex.

Why relationships still move rounds

At early stage, there’s limited hard data. Signals travel through networks: a credible operator vouches for you; an admired founder forwards your note; a partner hears about your traction twice in one week. That’s why warm introductions have historically outperformed cold outreach in venture, even as cold emails have become more accepted. The point isn’t to gatekeep—it’s to borrow trust and compress the path to a first meeting. Multiple investor guides continue to emphasize the value of warm paths, even while acknowledging that a crisp cold email can work.

And when you do get in front of a partner, attention is scarce: recent DocSend tracking shows investors spend roughly ~2–3 minutes on a deck. You won’t win by burying the lede—you win with a fast, legible story and a short next step.

Step 1: Map your warm paths (who-knows-who, at a glance)

Open the investor’s profile in Rolodex and see who on your team knows them (or knows someone who does). Filter by role, firm, geography, or portfolio overlap to pick the path that makes sense for this partner. If you don’t have a direct route, look for credible adjacent paths: a portfolio founder they’ve backed, an operator they regularly co-invest with, or a customer CEO they trust (customer-led intros are underrated gold). Many VC operators explicitly note that the quality of the introducer matters as much as the intro itself.

Create a short note on the contact (“Choosing path via Priya—she’s a portfolio founder and close to this partnership”) so your team sees the rationale in the Activity Feed before you make the ask.

Step 2: Ask the intro the right way (double opt-in, one-screen)

Warm intros work when they’re easy on the introducer. Send a private, skimmable request (double opt-in): 3–5 sentences max, a clear “why now,” and a forwardable blurb the introducer can paste. Keep the goal small—get a first conversation, not a term sheet via email. Many leading programs and investors reinforce the same pattern: short, obvious value; specific ask; easy rejection path.

Track the request in a simple Boards View (Requested → Intro Sent → Meeting → Outcome) with a named owner and light SLAs (reply within 1 business day; propose times within 24 hours; thank the introducer within 24 hours post-meeting). Treat intros like a pipeline asset, not a favor drifting in DMs.

Step 3: Send a one-screen investor brief (the “hook,” not a data room)

Before or immediately after the intro, share a one-pager designed to earn the next 20 minutes. Think of it as your elevator pitch on a page: problem shift (“what changed”), what you do, traction that proves it, business model/unit economics in one line, team credibility, the round you’re raising, and the single, obvious next step. The best investor guidance agrees: the goal of a one-pager is to get the meeting, not answer every question. Keep it crisp; let depth come live.

Step 4: Run the first meeting like a system (and respect the two-minute reality)

Because deck skim time is short, open with your sharpest signal—what changed in the market, why your wedge is working, and the data that proves it—then get interactive. Sequoia’s public guidance is directionally useful here: earn attention in the first five minutes with a tight opening sequence, then dive deeper. After the call, log a one-screen note (“Current Truth”) in Rolodex: decision, risks, next steps, and owners—then attach the deck you actually presented. Your future self (and your co-founder) will thank you.

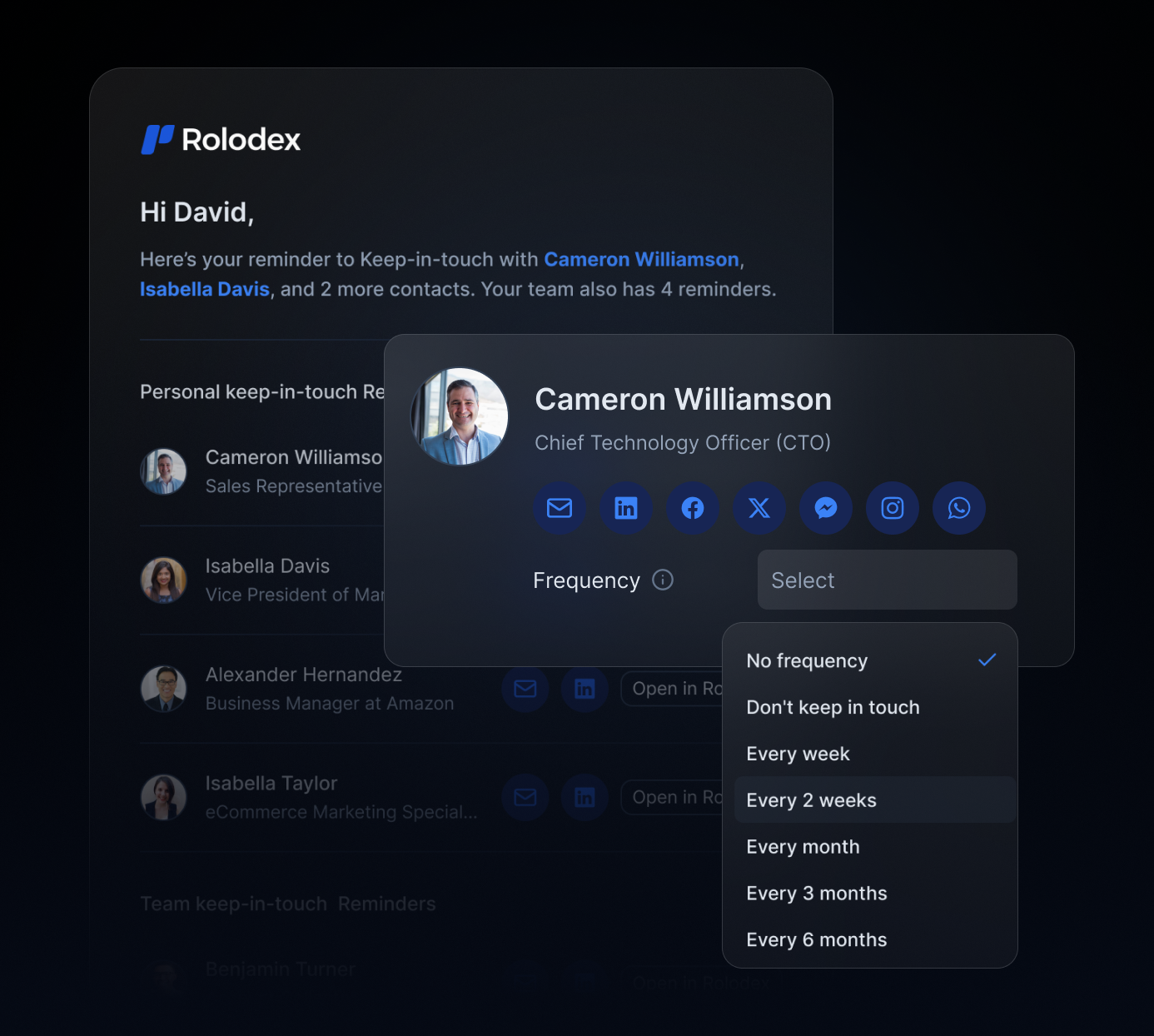

Step 5: Keep partners—and introducers—in the loop

Close the loop with the introducer (“We met; moving to partner meeting in two weeks—thank you!”). For investors who are leaning in, send lightweight updates that maintain momentum: key wins, hiring, new logo, and the single blocker you’re solving next. Seasoned operators argue that consistent, clear updates build trust and shorten cycles; modern templates converge on the same few elements (headlines, KPIs, hires/customers, needs). Save each update as a note so the Activity Feed tells the story in one scroll.

Step 6: Scale the motion across your team (without losing context)

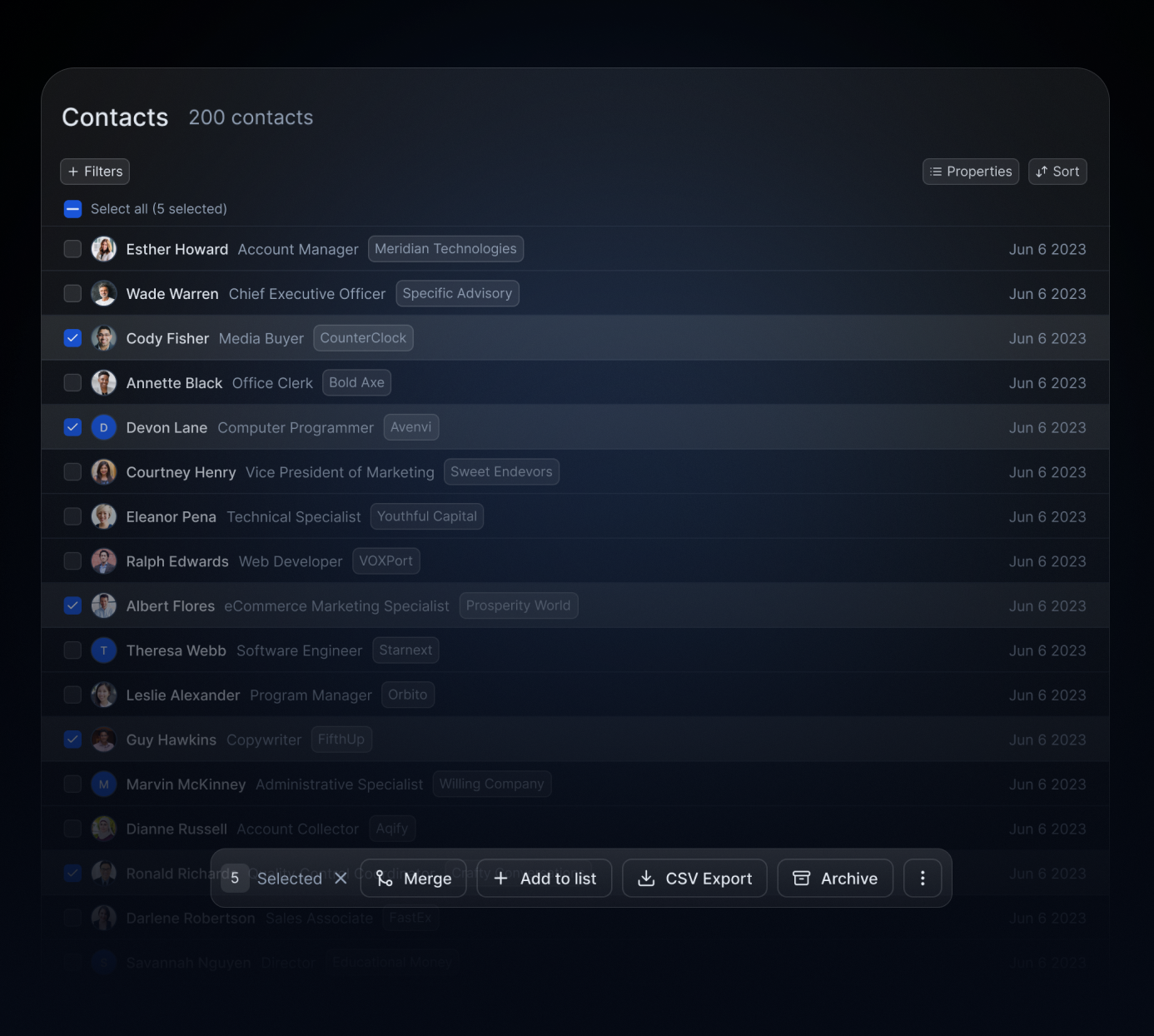

Fundraising fails in the handoffs. Rolodex keeps everyone aligned:

Boards View: every intro and meeting tracked to outcome—no duplicate pings, no forgotten thank-yous.

Notes & Attachments: decisions and files pinned to the investor’s contact, so a partner email never forces you to spelunk through Slack.

Keep-in-Touch: cadences for friendly funds and helpful angels (monthly during an active raise; quarterly otherwise).

Title Alerts: partners change firms and roles—get the heads-up and reconnect with a congrats at the perfect moment.

Cold outreach vs. warm paths (be pragmatic, not dogmatic)

A clean, well-researched cold email can absolutely work—especially when you’re outside the Bay Area bubble or building in a less networked category. YC’s own guidance shows how to write a tight investor email. That said, warm paths still compress trust and time. Use both: map the warmest route first; if none exists, send a crisp cold note with your one-pager and a specific next step.

What good looks like (your checklist)

You can answer “who knows whom” for every target partner.

Every intro request is tracked with an owner and an SLA.

Your one-pager is current, attached to contacts, and reads in one minute.

After each call, a “Current Truth” note captures what changed and what’s next.

Introducers get thanked; friendly funds get steady updates.

That’s relationship-led fundraising: systematic, respectful, and fast.

Bring it together with Rolodex

Rolodex is the calm layer that keeps this motion together—who-knows-who visibility, Boards View for intros and meetings, activity feed for the “current truth,” Keep-in-Touch cadences so interest doesn’t cool, and Title Alerts so you reconnect at exactly the right time. Pair that with a tight one-pager and you’ve got a fundraising engine that treats relationships like the assets they are.

Go raise the round—through people, not spreadsheets.

References & further reading

OpenVC on the outperformance of warm introductions, with sources and practical tactics to find them. openvc.app

Y Combinator on how to email early-stage investors—short, concrete, and with a specific ask (useful for both cold and warm). Y Combinator

DocSend / Dropbox research on deck attention windows (~2–3 minutes), underscoring the need for a sharp hook and one-pager. docsend.com+1

Sequoia Capital on structuring your first five minutes to earn attention before depth. Sequoia Capital Articles

Investor update best practices (examples & checklists) to maintain momentum and trust between meetings. Medium